iowa city homestead tax credit

52240 The Homestead Credit is available to all homeowners who own and occupy the. 913 S Dubuque St.

Pin On Multifamily Property Management News Tips Ideas Jobs

Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit.

. The homestead tax credit is a small tax break for homeowners on their primary residenceif you live in the greater iowa city area in johnson county you can apply for the homestead credit with a quick visit to the johnson county assessors siteyoull need to scroll down to find the link for the homestead tax credit application. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Brad Comer Assessor.

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. To qualify you must live in the Iowa property you own for 6 months of the year be an Iowa resident and live in the home on July 1. The credit will continue without further signing as long as it continues to qualify or until is is sold.

Disabled Veteran Homestead Tax Credit page 2. When it comes to the homestead exemption its up to you to take the initiative. It must be postmarked by July 1.

This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount. Brad Comer Assessor Marty Burkle Chief Deputy Assessor. The homestead credit is a tax credit funded by the state of iowa for qualifying homeowners and is generally based on the first 4850 of net taxable value.

Homestead Tax Credit Sign up deadline. Homestead Tax Credit Application 54-028. Applications can be completed at our office or obtained online by clicking on Additional.

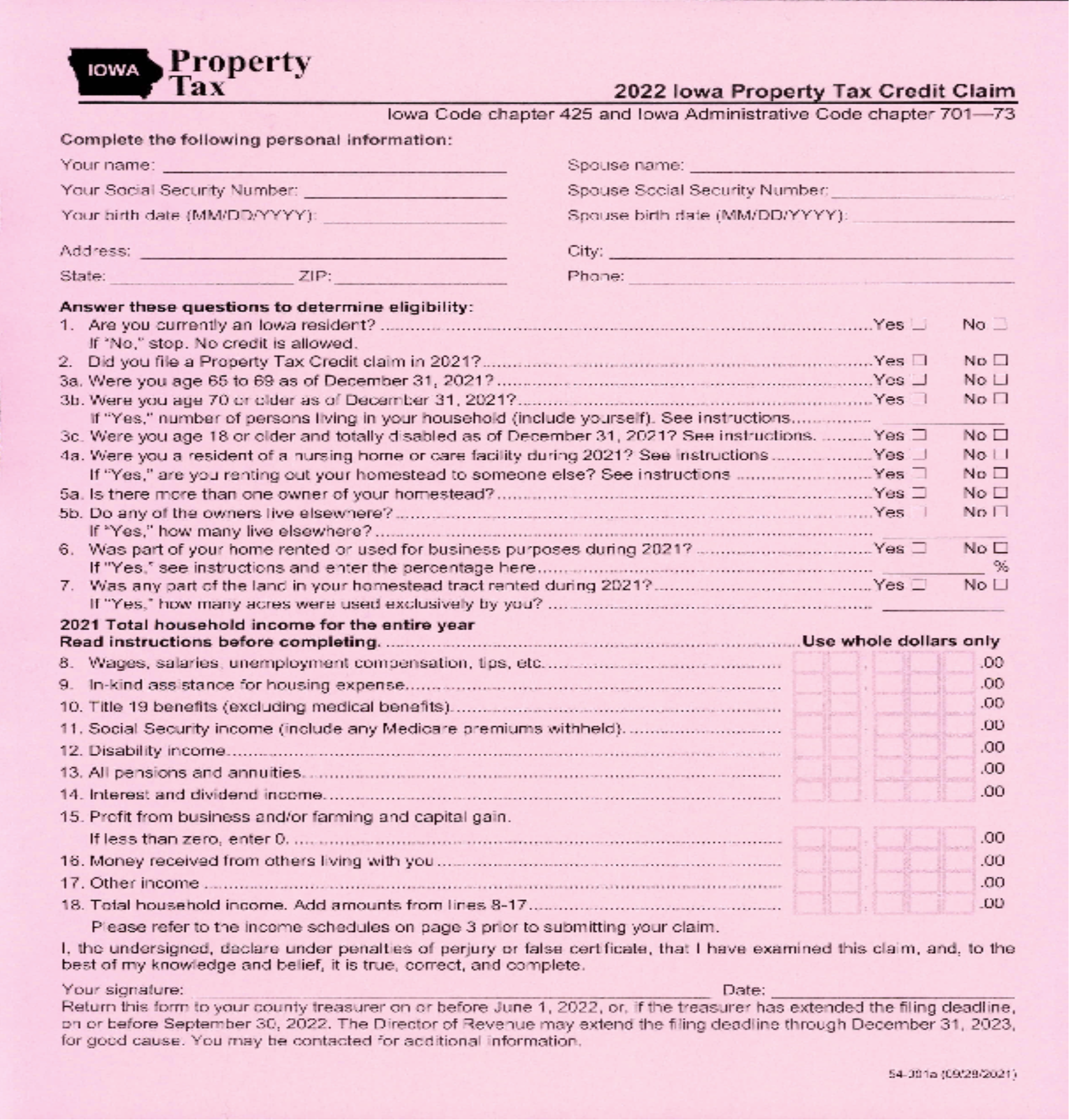

Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Be set at 4 today.

It is a onetime only sign up and is valid for as long as you own and occupy the home. Upon filing and allowance of the claim the claim is allowed on that. Iowa City Assessor.

Must own and occupy the property as a homestead on July 1 of each year declare residency in Iowa for income tax purposes and occupy the property for at least six months each year. Iowa Finance Authority 1963 Bell Avenue Suite 200 Des Moines Iowa 50315. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Learn About Property Tax. Persons in the military or nursing homes who do not occupy the home are also eligible.

What is a Homestead Tax Credit. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. The federal low-income housing tax credit program acts as an incentive for property owners to invest in the development of rental housing for individuals and families with fixed or limited incomes.

Dubuque Street Iowa City IA 52240 Voice. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. Law.

To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. The credit is a reduction in the amount of property tax owed. For properties located within city limits the maximum size is 12 acre where the home and the buildings if any are located.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. File a W-2 or 1099. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value.

July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. Upon the filing. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year.

Tax Credits. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. 54-049b 10192020 FACT SHEET.

Iowa City Assessor 913 S. Instructions for Homestead Application You must print sign and mail this application to. The homestead credit is calculated by dividing the homestead credit value of 485000 by 1000 and multiplying by the consolidated tax levy rate.

Military Service Tax Exemption Application 54-146. It is not a refund. The document has moved here.

NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits. 54-019a 121619 IOWA. It must be postmarked by July 1.

The current credit is equal to the actual tax levy on. Disabled Veterans Homestead Application - 54-049a. Iowa City Assessor 913 S.

How the Homestead Exemption Works. Adopted and Filed Rules. In the state of Iowa this portion is the first 4850 of your propertys net taxable value.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Homestead Credit The Homestead Credit is available to residential property owners that own and occupy their property as their primary residence. What is the Credit.

Originally adopted to encourage home ownership through property tax relief. Homestead Tax Credit Iowa Code chapter 425. If you owned another.

Dubuque Street Iowa City IA 52240 Voice. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa. Iowa Homestead Credit Description.

Refer to Code of Iowa Chapter 425. The current credit is equal to the actual tax levy on the first 4850 of actual value. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the.

Youll need to scroll down to find the link for the Homestead Tax Credit Application. Learn About Sales. Upon filing and allowance of the claim the claim is allowed on that.

To qualify for the credit the property owner must be a resident of.

Harrison County Assessor Tax Credits Property Tax How To Apply

Save Thousands Of Dollars Every Year By Appealing Your Property Taxes Real Estate Investing Things To Sell Hotel Price

Google Image Result For Http Wwp Greenwichmeantime Com Images Usa Wisconsin J Wisconsin Travel Wisconsin Exploring Wisconsin

Property Tax Relief Polk County Iowa

What Is A Homestead Exemption And How Does It Work Lendingtree

Map Of Property Taxes On Business Inventory By State American History Timeline Map Rapid City

11 00 Acres Land For Sale In Texas Texas Land For Sale Land For Sale Dream Properties

Best States To Retired In With The Lowest Cost Of Living Finance 101 Gas Tax Healthcare Costs Better Healthcare

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Iowa Is Top Of The List For Retirement States Video In 2021 Iowa House Styles Picturesque

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map States Cost Of Living

W 9 Form Sample Elegant 15 Unique Free Printable Employment Pertaining To Free W 9 For Separation Agreement Template Social Security Benefits Contract Template

Property Taxes Marion County Iowa

Living Outside The City Has Always Been An Attractive Option For Many But With Housing Prices In Seattle Going Suburbs Washington Things To Do Housing Market

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Contract Template Social Security Benefits

Buy An Investment Property In 2018 S Top 9 Undervalued Real Estate Markets Buying Investment Property Real Estate Marketing Investment Property

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Further Proof It S Not 2008 All Over Again Keeping Current Matters Equity Home Equity Line Of Credit

Oldhouses Com 1890 Victorian Queen Anne Beautiful Queen Anne Victorian In Historic Gold Coast In Davenp Victorian Homes Victorian Style Homes Fancy Houses